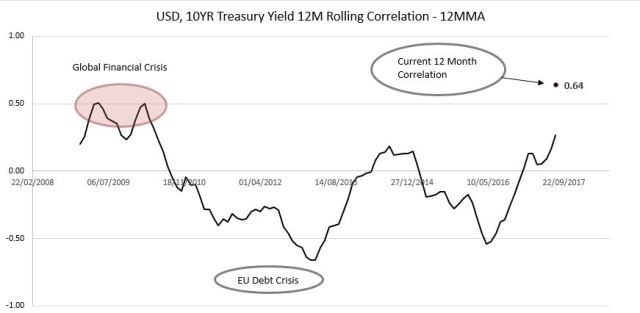

This very first post to my new research site, on which I want to share with you my observations on the current situation of financial markets, would be about the US Dollar and the US 10 Year Treasury Bond Yield. These two assets considered the safe heavens in their classes, have been having very fluctuating relationship dependent on global market conditions.

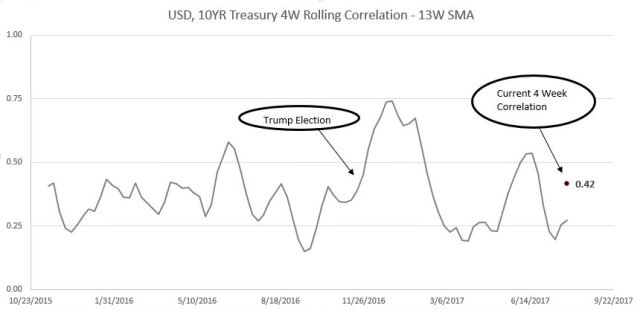

Traditionally when investors feel the heat they run for longer term US treasuries, pushing yields down and run away from riskier assets (i.e. equities) which forces a dollar sell off. Remember that bond interest rates and bond prices have a reverse relationship, when bond yield is rising this means that price of the bond is falling, and vice versa. After the euphoria and optimism around Donald Trump election we saw the reverse – a run for riskier assets in the face of equities, which brought international money into the US pushing the dollar higher. On the other side these flows had to come from somewhere and we saw a sell off in bonds which pushed interest rates higher. This is reflected in the higher 13-week average correlation at the end of 2016.

Looking at the past ten years bellow we can see that the relationship represented by the 12-month average correlation peaked in the highs of the last recession. However, we can observe that global turmoils also affect this relationship – during the European Debt crisis there was also, much smaller in proportions a run for treasuries. The difference in this instance is that investors also didn’t trust the Euro as a currency and piled in to the USD, hence the reason for the extremely negative correlation.

Overall, we can say that in the past few months we have been seeing a dollar weakness which is mostly reflected in euro strength. This is mostly due to the positive sentiment on the European economy. However, EU stocks started to sell off in the last two months, which could have two reasons behind it – first the strengthening of the Euro which makes EU stocks more expensive; and global economic risks rising which will include peak in the short term credit cycle.

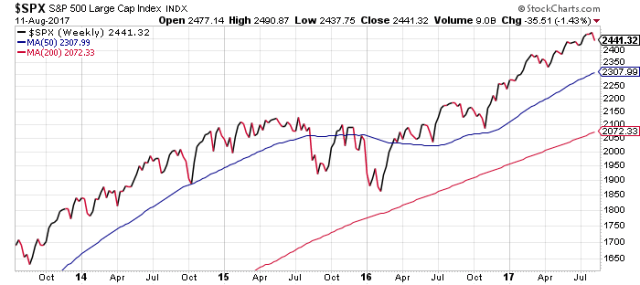

For now we see US stocks still holding the record highs, but bond yields starting to fall already, keeping the correlation up. Next months look like a good time to start shifting from more volatile and riskier industries to more defensive ones. Also, would be a good idea to increase the overall proportion of bonds in the portfolio, as yields might continue falling and a sell off in stocks is more likely.