Over the past two years there has been a wave of populism rising and a lot of talk about lost manufacturing jobs. This fortunately in Europe didn’t give power to protectionist governments, however we are currently experiencing Brexit and Trump presidency. In order to stay cool in the markets and try to understand the global economy we would need to look beyond these events and to see if they have any reasonable backing by the data. We shall look into regions of the world, not to individual countries, but of course we will have in the back of our minds the fact that China has seen tremendous growth in the past two decades. In this observation I have looked at data from 1996 to 2016 provided by the World Bank.

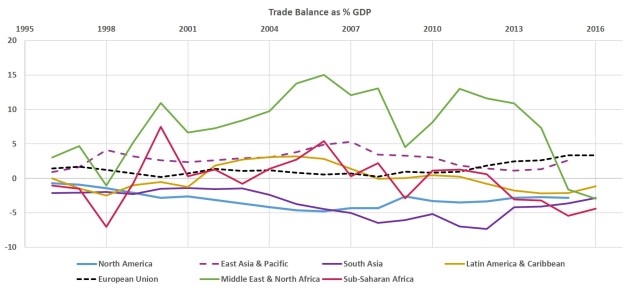

Some politicians are claiming that the labor market and trade balance has shifted globally. Indeed the trade balance of East Asia is positive at around 2.5% of GDP in contrast with North America’s at -3.8% of GDP. While the EU is keeping a positive balance through the period that has increased in the current recovery. But this trade balances have been around these numbers for over two decades, so it is not a recent imbalance.

It is worth noting in the chart below the sharp drop in the trade balance that the Middle East is experiencing since 2013. From this drop we can see how their oil driven imbalanced economy is at risk from price fluctuations.

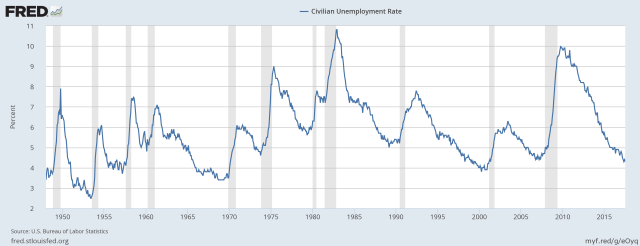

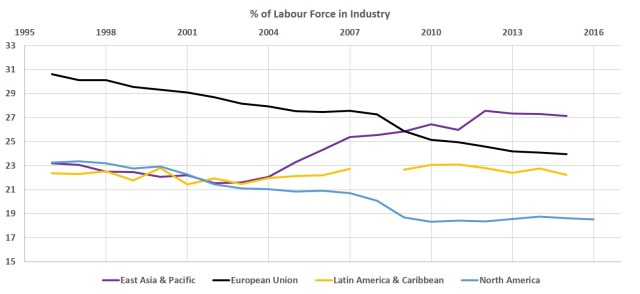

Further, if we look at labor data below, we can see that before the 2008 recession there was a trend of shifting industry jobs from North America and EU to East Asia. However, industry jobs in East Asia started to rise after the 2001 recession. This trend accelerated sharply during the Great Recession years, in one part due to companies trying to lower input costs and also further opening of the Chinese economy.

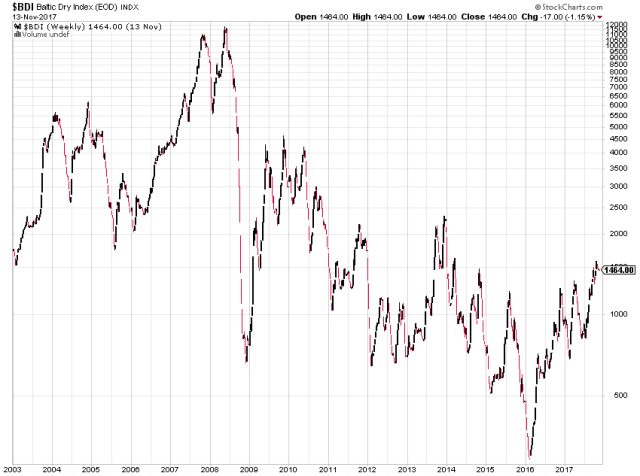

Also, the international shipping costs, as measured by the Baltic Dry Index below, after 2008 sharply dropped and have been on a downward trend ever since. This we can argue further motivated companies to produce wherever the labor was cheap and to ship goods globally.

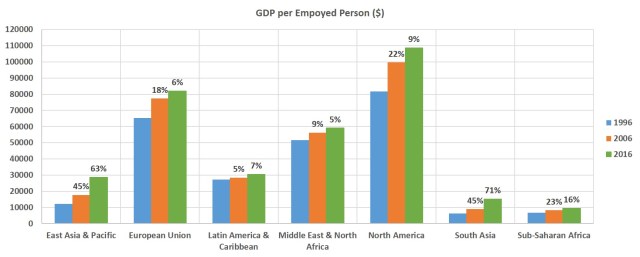

These shifts led to outperforming growth in productivity. East Asia saw 45% and 63% increase in GDP per employed person in the past two decades respectively. This compared to the EU’s 18% and 6% looks astonishing. North America however didn’t do bad, with the third best growth for the period – 22% and 9%. We need to keep in mind that these percentage growth rates are on a different basis and 22% on $81k is over $17k of GDP per employee for North America, while 45% on $12k is just over $5k in East Asia. So we can say that the developing world has a lot of catching up to do.

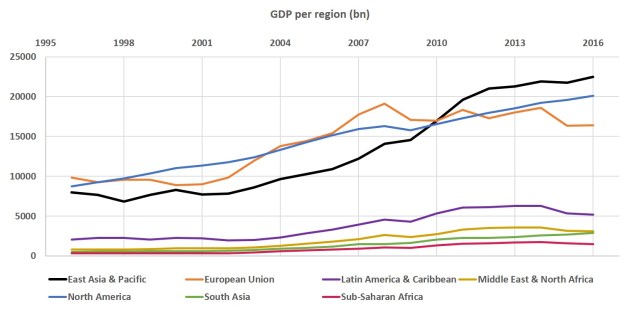

The greater factor contributing to East Asia & Pacific region being able to surpass the EU and North America in total GDP is clearly the bigger labor force. This labor force, however is not very skillful and is employed in manual manufacturing. It is worth noting that the developed world is burdened with higher levels of public debt, which is limiting governments’ options to boost growth to reforms, rather than spending. Take the EU, which in the past several years experienced numerous debt crises leading to no growth of the regions’ economy. One can easily draw parallels with hyper indebted Japan and their lost decade.

We need not to give such credit to these manufacturing jobs in Asia as politicians are, as if you look at the technology available today it is just a matter of time that labor in the developing regions become expensive enough to be replaced by automated/robotic labor. From this statement we can argue that North America is probably better positioned for the years ahead, as not only the economy is more service driven which requires higher skill sets, but also they posses the best technology in the world.

However, there is more to be done in developed America in adjusting the education system to the requirements of new industries. In Internet usage we can see below that the EU and North America have great advantage over other parts of the world with 80% of the population using the Internet in these regions.

This is definitely another factor that gave rise to globalization and is probably a major contributor for this global shift in industrial jobs. As it made it easier for international trade to be conducted and for businesses to operate in multiple locations. Further, this as part of other technologies is probably one of the greatest advantages of the western world. So looking into these jobs shifted to Asia, that many claim will never go back to America there is also a positive side. This will hopefully prompt politicians to look ahead and beyond and work towards giving their workers a competitive edge for the service industries that are yet to emerge. These industries will most likely be oriented around computer science, AI and robotics.

Unfortunately for now populism is winning in US and UK where politicians instead of trying to look beyond hate and division are missing an opportunity to unite, modernize and push positive changes ahead. There are a few beacons of positivism had emerged in the face of Canadian prime minister Justin Trudeau and French president Emmanuel Macron, who seems to have support for major needed reforms.