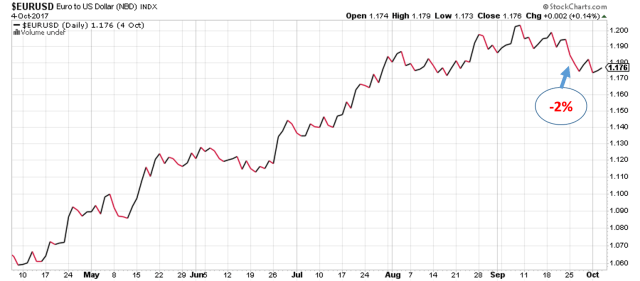

About two weeks before the Federal Reserve announced that it will start shrinking its balance sheet we started to see dollar strength, as you can see from the EURUSD chart below. A 2% decline was triggered by the announcement on 20 September, however if we are following closely the markets, as we should be doing, we can observe signals for this decline several weeks before it happened.

As the Fed announced its plans for selling US government treasury and agency securities in order to reduce its balance sheet the market orderly followed and adjusted the rate of the benchmark 10-year bond. The rate rose by over 8.5% in a matter of 2 weeks prior to the announcement and further 4.7% after.

Indication of future dollar strength was observed in The London Interbank Offered Rate or LIBOR market. Since London accounts for over 40% of world currency trade volume the benchmark rate appears to be a very accurate barometer for currency swings. US Dollar 3-month LIBOR rose 2.8% since early September, which compared to the Euro rate is a significant rise.

What is fascinating is that the balance sheet reduction hasn’t even started and we are seeing this dollar strength which if leveraged only 5 times would yield a hefty 10% in the matter of two weeks. We cannot be absolutely certain that the dollar will continue to rise, but there appears to be some very serious market sings that this will be the case.

In addition it would be interesting to factor in the devastation from this year’s hurricanes and how they would impact the economy. Most suggestions are for boost to the economy and we should know that a strong economy is an underpinning factor for strong currency.